28+ Retirement income projection

Human trafficking can occur within a country or trans-nationally. You will be entitled to receive plan benefits after.

2

For example if youre filing as single or head of household and have a modified adjusted gross income of 66000 or less for 2021 68000 or less for 2022 you can take a full deduction.

. Retirement calculators vary in the extent to which they take taxes social security pensions and other sources of retirement income and expenditures into account. April 21 2022 at 109 pm. Clearly a 5.

Strangers friends surprise man battling cancer with car show. We provide an income projection for both your current strategy as well as any modeled strategy. The amount of Social Security income that is considered taxable is based on publication 915 for federal income tax and state-specific rules for state income tax.

Copy and paste this code into your website. Federal government websites often end in gov or mil. The assumptions keyed into a retirement calculator are critical.

If you or your spouse has a retirement plan at work you may be able to deduct your full contribution take a partial deduction or have no deduction. Its way too early to have an accurate projection. A 5 savings rate doesnt place her savings at even 50 of the funds shell need.

One of the most important assumptions is the assumed rate of real after inflation investment return. GDP - In the first quarter of 2022 recorded an average daily oil production of 149 million barrels per day mbpd lower than the daily average production of 172mbpd recorded in the same quarter of. Public health nurses may travel to community centers schools and other sites.

28 42 21 31 11000 23 34 17 26 12000 21 32 16 24. My retirement income from former employer plus social security has my earnings at less then 40 of my pre retirement income. Retirement income is typically taxed either when the income is savedcontributed or at the time the income is received.

In fiscal year 2020 the value of the more than 200 tax expenditures in the individual and corporate income tax systems will total about 18 trillionor 80 percent of GDPif their effects on payroll as well as income taxes are included. So if your investments returned 7 in the last 12 months. 22 That amount which was calculated by CBO on the basis of estimates prepared by JCT equals almost.

Your real rate of return is your actual rate of return minus those factors particularly the inflation rate. Or GG payment of State or local tax assessed on the compensation of employees. Its easier to say pre-retirement income because that is known for everyone as opposed the pre-retirement spending which is highly variable.

This strategy does a reasonable job of balancing RMDs to keep income at about this same threshold but RMDs do force slightly higher total income for the rest of the retirement. PART II--Medicaid Provisions Sec. Human trafficking is the trade of humans for the purpose of forced labour sexual slavery or commercial sexual exploitation for the trafficker or others.

For non-Planner Plus users a blended federal-state income tax table is used with 2022 standard deduction amounts to approximate US national averages. While a budget may not be a must I think a spending projection is very much one and it may be different. Are calculated using a progressive benefit formula that replaces a much higher percentage of low-income workers pre-retirement.

In compliance with the Americans with Disabilities Act PERS will provide these documents in. Before sharing sensitive information make sure youre on a federal government site. 28 days ago Dick I normally find your articles to be super helpful.

The gov means its official. To match 85 of her pre-retirement income in retirement Beth needs 13 million at age 67. The Employees Retirement Plan is a pension plan designed to provide you with a guaranteed monthly income at your retirement paid entirely by Duke.

To view them you must have the most recent version of Adobe Reader. This may encompass providing a spouse in the context of forced marriage or the extraction of organs or tissues including for surrogacy and ova removal. Most experts say your retirement income should be about 80 of your final pre-retirement annual income.

Retirement Income Projections and Withdrawal Assumptions. Ill appreciate that forever. Extension of funding outreach and assistance for low-income programs.

I never asked nor received any government assistance etc during the 48 years I worked. Sections 1453b and c of this title referred to in par. The volume of the net inflow of migrants to high-income countries in 2010-2015 32 million per year represented a decline from a peak attained in 2005-2010 45 million per year.

In order to calculate your retirement income estimates and your post-retirement plan balance we use the 80th percentile from the 500 hypothetical return projections. This rate was higher by 528 points compared to the rate recorded same quarter of 2021 and 134 points higher than the fourth quarter of 2021. And bb the sum of payments of any compensation to or income of a sole proprietor or.

You automatically become a member of the plan if you are over age 21 and have completed one year of employment working at least 1000 hours. 37E was in the original sections 4403b and c meaning sections 4403b and c of the Employee Retirement Income Security Act of 1974 which was translated as section 1453b and c of this title as the probable intent of Congress in view of the Employee Retirement Income. The AGI strategy keeps total income at 109000 as there are no above-the-line deductions until age 72 when RMDs begin.

Nurses who work in home health travel to patients homes. PERS provides some online publications in pdf format. Download the latest version of Adobe Reader.

The tax treatment of private pension income and retirement savings accounts is designed to avoid double taxation. Ambulatory healthcare services includes industries such as physicians offices home healthcare and outpatient care centers. The projection for the exhaustion date of this event was moved up slightly after the recession worsened the US.

April 21 2022 at 1128 am. Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more. Your nominal rate of return is the amount of money you make from an investment before factoring in expenses such as taxes investment fees and most importantly inflation.

FF payment of any retirement benefit.

Health Care For Life Will Teachers Post Retirement Benefits Break The Bank Document Gale Academic Onefile

2

Health Care For Life Will Teachers Post Retirement Benefits Break The Bank Document Gale Academic Onefile

Health Care For Life Will Teachers Post Retirement Benefits Break The Bank Document Gale Academic Onefile

2

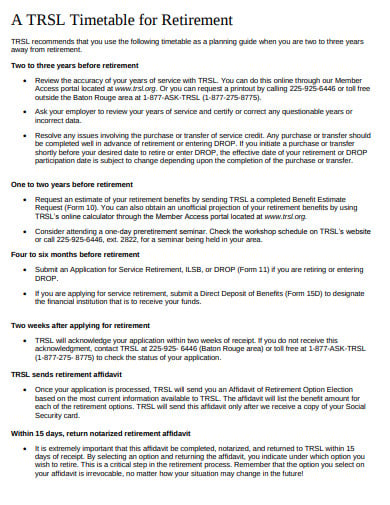

10 Retirement Timeline Templates In Pdf Free Premium Templates

2

10 Retirement Timeline Templates In Pdf Free Premium Templates

2

2

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Excel Templates Templates Invoice Template

Simple Project Expense Report Template Google Docs Google Sheets Word Template Net Report Template Easy Projects Small Business Planner

2

If You Have A Pension How Do You View It Bogleheads Org

2

Pdf The Effect Of Changes In Wages Gdp And Workers Demographic Characteristics On Working Hours

2